How Wildfires are affecting insurance premiums on the west coast

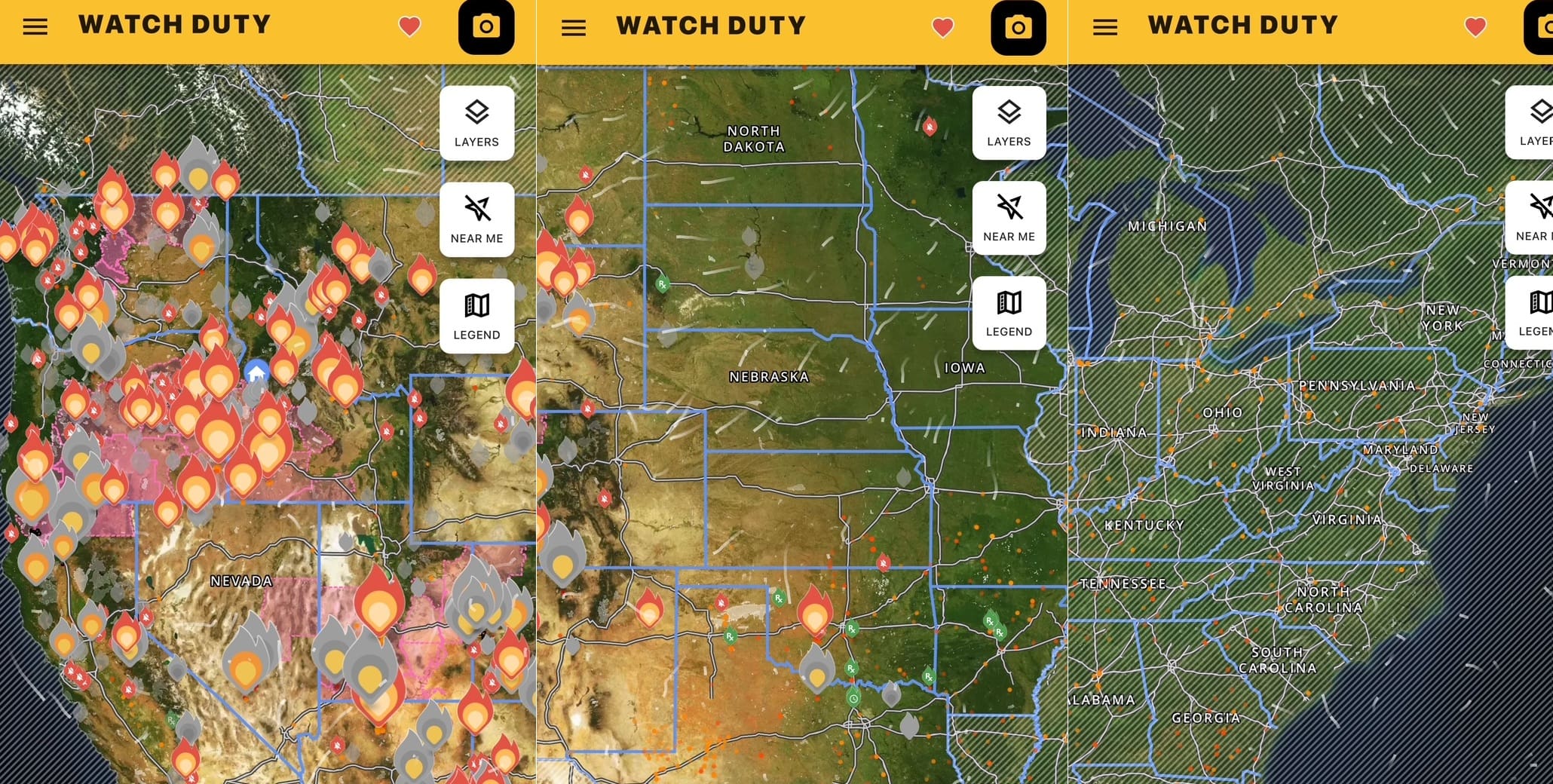

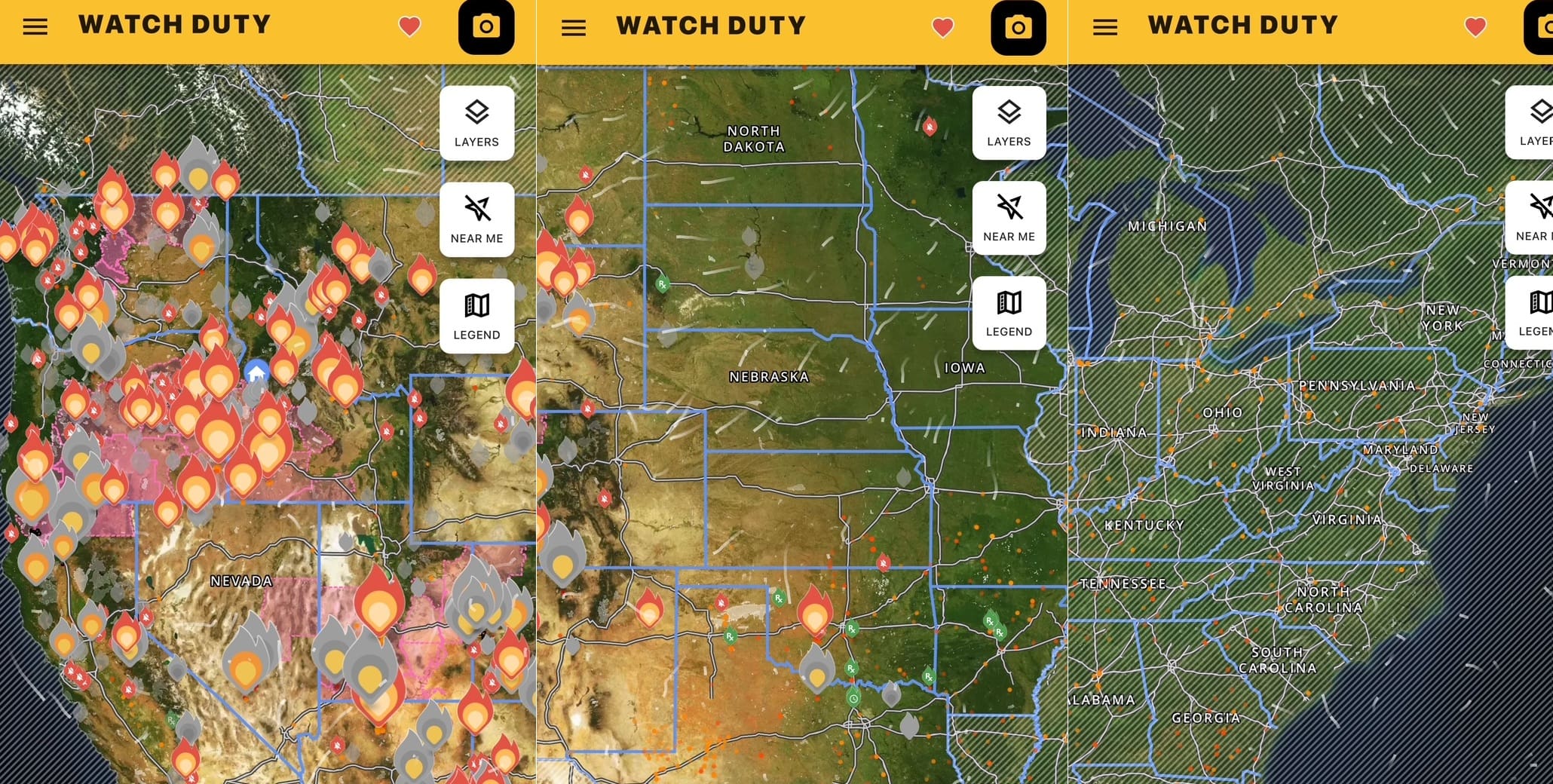

Wildfires along the U.S. West Coast—particularly the devastating Los Angeles-area fires in January 2025—are significantly reshaping the insurance landscape, especially in California, Oregon, and Washington. Here’s how those disasters are affecting insurance premiums and policy access:

🔥 1. Rising Premiums in High-Risk Areas

-

In California, insurers such as State Farm and Travelers raised homeowners policy rates by double-digit percentages through early-to-mid 2024. Average premiums rose above $2,000 per year for a typical policy Wikipedia+6https://www.wsaw.com+6EveryCRSReport+6San Francisco Chronicle.

-

After the January 2025 fires, Moody’s reported property insurance losses could reach $28–30 billion and urged insurers to seek large premium increases—State Farm applied for up to +30%, while Allstate requested +34% Insurance Journal.

-

S&P Global predicts dramatic premium hikes across California, Oregon, and Washington even though these states historically had lower average premiums. MarketWatch

🛑 2. Insurer Pullback & Policy Non-Renewals

-

Seven of the top 12 California insurers have halted new homeowners policies or limited renewals by 2024. State Farm stopped new business in mid-2023 and canceled thousands of existing policies in high-risk ZIP codes Reddit+15NBC Los Angeles+15EveryCRSReport+15.

-

Policyholders in Oregon also report more frequent denials and even non-renewals based on elevated wildfire risk scores, with premiums jumping over 50% in rural and moderate-risk areas Reddit.

🏛 3. State-Run FAIR Plans as Last Resort

-

In California, homeowners who lose private coverage often turn to the FAIR Plan. But these policies are more costly, offer limited coverage (e.g. fire damage only, max. $3M), and may not account for full replacement costs California Department of Insurance+9Wikipedia+9NBC Los Angeles+9.

-

FAIR Plan enrollment more than doubled between 2020–2024, reaching ~452,000 policies, representing a major shift in market share https://www.wsaw.com+1NBC Los Angeles+1.

-

The FAIR Plan is under severe financial strain after covering major wildfire losses, with exposures far exceeding reserves—private insurers could be assessed to cover the shortfalls, which may drive up premiums even for non-FAIR policies deepskyclimate.com+1vox.com+1.

🏛 4. Regulatory Reforms & Reinsurance Rules

-

California regulators recently approved a new “Sustainable Insurance Strategy.” As of late July 2025, insurers are allowed to use forward‑looking wildfire catastrophe models (e.g. Verisk) when filing rates. Rates will now reflect climate change, mitigation efforts, terrain, and building features EveryCRSReport+2California Department of Insurance+2San Francisco Chronicle+2.

-

A new regulation permits insurers to include reinsurance costs in rate filings—previously prohibited—enabling insurers to justify higher premiums, especially in catastrophe-prone zones https://www.wsaw.com+4California Department of Insurance+4San Francisco Chronicle+4.

-

Insurers must now commit to covering at least 85% of their statewide market share in wildfire‑distressed areas, increasing coverage expansion in phases Wikipedia+4newsweek.com+4California Department of Insurance+4.

📉 5. Downstream Impacts on Housing Markets

-

Accelerating premium hikes and loss of private coverage threaten housing affordability. Homeowners—especially in middle-class neighborhoods—are increasingly underinsured, sometimes facing large out-of-pocket gaps to rebuild washingtonpost.com.

-

Some residents are moving out of California; Reddit users cite Oregon and Idaho as emerging alternatives due to lower insurance costs and availability Reddit.

Tips for homeowners:

-

Request your property’s wildfire risk score and ask insurers how mitigation actions (like defensible space or fire-resistant materials) might lower your premium.

-

Consult an independent insurance broker to shop around and explore bundling options.

-

Review your policy for underinsurance—especially rebuilding costs, personal property, and liability coverage gaps.

-

If enrolled in FAIR, consider adding “wrap-around” coverage to supplement protection, if available.